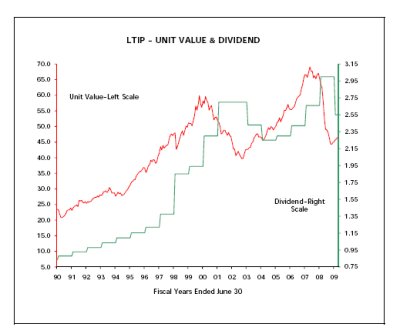

NACUBO released their annual endowment study today. Cornell ranks 17th in the country, with $3.966 B in endowment assets as of June 30th, 2009, just behind Washington University and just ahead of Rice. (Curiously, though, MIT is missing from the ranking, so I suspect that Cornell is really 18th.) You can see data from 2008 and 2007 here and here. NACUBO reports that the University lost 26.4 percent of its endowment in fiscal year 2009 -- the endowment stood at $5.385 B in June 2008. Unfortunately, this puts the University in some good company, as the New York Times reports: I've asked before whether or not the University takes too many risks with its endowment. The 26.4 percent number, however, is a bit of an understatement because it includes any funds that the University added to its endowment in FY2009. What we really need to know is how the endowment that existed as of June 30th, 2008 performed. which, in the interest of openness and transparency, the University kindly provides for us. First, though, a little bit on how the University's endowment works. Any unit associated with the school can purchase 'shares' in the endowment, provided that the initial purchase is greater than $100,000. (This amount used to be $10,000 but the University recently increased it due to administrative costs.) The shares than function exactly like a mutual fund -- the underlying values of the shares change while the shares also produce dividends that can be used for the unit's operating expenses (e.g. financial aid or professor salaries) or re-invested back into the endowment by purchasing more shares. Here's a chart:Unusually, the universities with endowments over $1 billion had the greatest decline, an average of 20.5 percent. Harvard, Yale and Stanford, the wealthiest universities, all lost more than 26 percent of their endowment values.

So what we can see is that between FY2008 and FY2009, a share in the University's endowment fund actually fell from $65.37 to $45.12, a decline of 31 percent. (To be fair, it also produced a $3 dollar dividend.) This is a little bit bigger drop than the 26 percent from what was previously reported.

What is even more striking is how flat the overall value of endowment shares has been in the last 11 years. In June 1998, a share was worth $47.65, while in September 2009, a share was worth $46.65.

At the same time, though, the fund produced over $30 in dividends per share, for a 'true' return of over 60 percent -- better than the 40 percent that the S&P 500 returned over the same. This shows the endowment has definitely been very beneficial for the university.