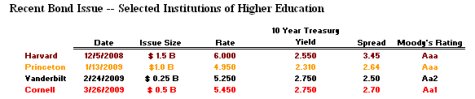

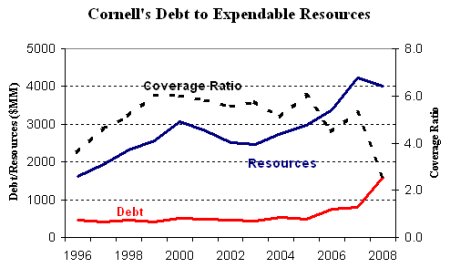

The Sun is running a decent article on the University's taxable bond issue last week. We learn that Cornell was able to raise $250 MM in five year notes at 4.35% and $250 MM in ten year notes at 5.45%. We also learn that the University is set to raise another $305 MM in non-taxable debt through the State Dormitory Authority this week, in a long-planned offering designed to provide further working capital for the University's ongoing construction projects. The good news is that when compared to Harvard's bond issue in late December, Cornell will enjoy a lower interest rate 'spread' relative to Ten Year Treasuries. In fact, the premium that Cornell ends up paying for its debt -- 270 basis points -- is much more in line with Princeton's (at 264 basis points) than Harvard's (with a 345 basis point spread over Treasuries). Keep in mind that while both Princeton and Harvard are rated Aaa by Moody's (the highest grade possible), Cornell is one notch below at Aa1. Of course, even though Cornell may be enjoying cheaper rates than Harvard, this doesn't mean that Cornell is seen as less of a credit risk than our counterparts in Cambridge. For one, Harvard raised their debt in December, when credit markets were decidedly a bit more jittery. And two, Cornell only raised one-third as much debt as Harvard did. As I suggested a couple of weeks ago, all things equal, Cornell will enjoy lower rates due to the smaller size of its debt issue. This fact is reflected in Vanderbilt's issue of $250 MM (only 50 percent of that of Cornell) last month -- where slightly better rates were enjoyed despite Vanderbilt's marginally worse Aa2 rating. Still, one can't help but marvel at the amount of indebtedness the University has taken upon itself in the past month -- its debt load will basically double overnight, from $800 MM to over $1600 MM. And an important measure of fiscal health -- the ratio of expandable resources to debt (e.g. 'coverage') will be halved. This comes after more than 12 years of stable debt and asset levels, and is why Standard & Poor's downgraded the University's credit rating. For more information on the history of Cornell's debt financing, I would recommend perusing the latest financial report of the University. While the irony of the University needing to raise more debt in a time when debt has been broadly chastised as a source of the world's economic woes is not lost on us, I do feel that these actions reflect the necessary financial stewardship by Day Hall. After all, institutions of higher education can afford to take a long-term view of their finances, and the time is ripe to continue to make investments in basic research and education. The opportunity cost of not continuing to invest in an institution as successful as Cornell is greater than ever.

| ||